How It Works

How It Works | Setting the Proper Expectations for Life, Property & Casualty Insurance Yorba Linda

“A man who dies without adequate life insurance should have to come back and see the mess he created.”

– Will Rogers

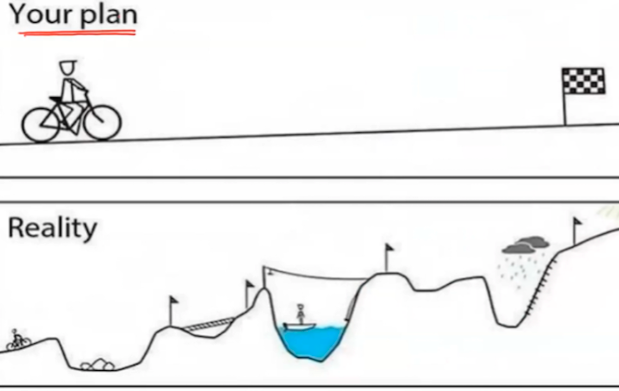

Navigating the financial journey of protecting your future doesn’t have to be complicated. Life is bound to throw a number of unwanted challenges, in the form of sudden accidents, property damages, or even untimely death. Fear not! By the right planning, preparation, and execution, one can take head-on those jolts and still accomplish most of his or her crucial life goals. That’s where life, property, and casualty insurance come in. For those looking for reliable coverage, our team offers top-tier property and casualty insurance Yorba Linda homeowners as well as business owners can feel secure depending on to protect their most valuable assets.

What to Expect Throughout the Process

Buying insurance isn’t like picking up a commodity at a store. Sure, you can buy a quick policy online, but is it truly protecting you? Life, property, and casualty insurance are about when something happens, not if—whether it’s a house fire, a car accident, or a sudden loss of income. This isn’t just a financial decision; it’s about saving your loved ones and ensuring a lasting legacy. That’s why we prioritize human connection and personalized guidance.

Think of our first meeting as a first date. This is going to be our opportunity to get to know one another, to gain some trust, and see if we’re going to be a good fit for each other-to work together. If not, we will at least equip you with knowledge and tools on how to protect yourself.

Step 1 | Understanding Your Current Situation

The first step is understanding your family’s unique financial risks—from loss of income to property damage. This means assessing:

- Your goals, values, and vision for your family’s future.

- Mortgage and major debt protection.

- Coverage needs for home, auto, and life insurance.

- Financial support needed if the primary breadwinner were to pass away.

No two families are the same, so we take the time to tailor your coverage accordingly. From home protection to liability coverage, our customized approach ensures that residents searching for life or property and casualty insurance Yorba Linda can trust receive the right level of protection for their needs.

Education | Knowing Your Options

Once we understand your needs, we’ll educate you on your best options. Insurance isn’t one-size-fits-all, and we break down:

- The different types of life, property, and casualty insurance policies available.

- The benefits and limitations of each type.

- How to determine the right amount of coverage for your situation.

When it comes to selecting the right insurance Yorba Linda residents must consider factors such as local risk exposure, property values, and liability concerns to ensure they have comprehensive coverage.

Key considerations:

- Insurance isn’t just about having coverage—it’s about having the right amount of protection.

- We partner with top-tier, mutually owned insurance companies that have been stable for over 100 years.

- Lower prices don’t always mean lower costs. We evaluate value beyond just premiums.

- The general guideline for life insurance is 15–30x your income, but we also factor in Human Life Value—the true worth of your future earnings.

- Property and casualty insurance should be customized to safeguard your most valuable assets, from your home to your vehicle.

If everything aligns, we’ll move forward to see if you qualify.

Step 2 | Application & Qualification

Our application process is thorough but smooth, ensuring you get the best possible rates and coverage. Communication is our #1 priority. To avoid delays, here’s what to expect:

Application Questions

You’ll be asked about:

- Lifestyle and financial background

- Medical history (for life insurance)

- Property and vehicle details (for casualty insurance)

Medical Exam (If Required)

For life insurance, a medical exam may be required. It’s quick and convenient—an examiner can come to your home to collect blood/urine samples and check vitals.

For property & casualty insurance, underwriting will assess risks based on home location, past claims, and vehicle records.

Underwriting Process

Once all information is gathered, the insurance company will assess your application. Insurers may request additional information if there have been previous claims, health conditions, or anything that might raise a red flag, but don’t sweat it. Be it home, auto, or business coverage, our seamless process cuts through the red tape to deliver fast approvals and unbeatable rates for insurance Yorba Linda policyholders.

Step 3 | Approval & Policy Customization

Once underwriting approves your policy, you’ll have the opportunity to:

- Adjust the coverage amount.

- Modify premiums if needed.

- Add riders for extra protection (e.g., flood insurance, umbrella liability, or disability coverage).

Free Look Period

Most policies include a free look period (10-30 days). If you’re not 100% satisfied, you can cancel with no penalty.

Follow-Up & Ongoing Support

Our relationship doesn’t end once your policy is in place. Life changes, and so should your coverage. We provide:

Annual Reviews

To adjust for life events like home purchases, job changes, or new vehicles. As life evolves, so do your insurance needs. Our ongoing policy reviews help clients with insurance Yorba Linda policies make necessary adjustments to maintain optimal coverage without overpaying.

Policy Optimization

We ensure your life, property, and casualty insurance are working together to maximize protection while minimizing unnecessary costs.

Securing Your Future | The Smart Move Forward

Getting insurance is not about ticking a box, but proactive financial protection: life insurance to cover your family’s future or property & casualty to protect your house and other assets-we’re here to help with informed, strategic decisions.

Let’s design a plan that gives you peace of mind, with security now and in perpetuity for you and your loved ones.

“It’s better to have it and not need it than to need it and not have it.